BY: TYE RUSTRUM & ANN RUSTRUM

Have you ever thought to yourself, “Where does all of my money go? Why don’t I have more of it? Am I ever going to get ahead in life? I’m working SO HARD and I still have no money.”

These were all feelings that Ann and I had until we finally got on a budget and put together a game plan to tackle our debt. I know, I know, just the word “budget” causes a lot of people to cringe. Trust me on this, there is actually great freedom in telling your money where to go rather than having your money tell you where you can go! It’s crazy to think that with two accounting degrees we didn’t have a personal budget a year out of college, but that’s where we were at. We were giving financial advice to people and our own finances weren’t on track!

It wasn’t until after we teamed up and asked for guidance from some very successful business owners that we were taught the power of a budget. Our own experience and struggle has created a passion within me to help people become financially literate at the youngest age possible. In school, we are taught about the nucleus of a cell, mathematical theories (that most people will never use in real life), or inadvertently how to cram for a test. I’m not totally against these things, I just think it is equally, if not more so, important to teach practical advice on real life – like budgeting. That’s why I decided to write this article, to give tips on how we were able to get out of debt, put money away for a rainy day, and put ourselves onto a solid path when it came to our finances. With that said, here we go – 5 steps to get your budget on track.

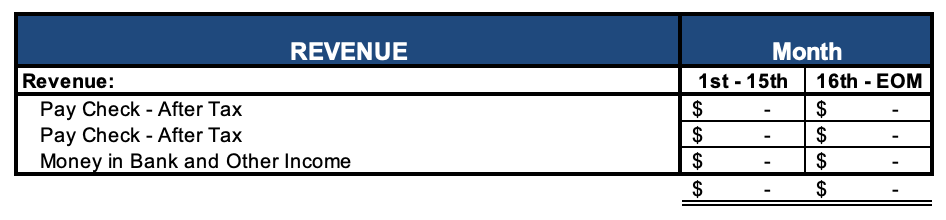

STEP 1: FIGURE OUT YOUR REAL INCOME

Oftentimes if you ask someone how much they make, they will tell you their gross income, not their net income. In order to know what you’re really working with, you need to know your net (“take home”) income. In other words, how much is your actual paycheck or what is actually deposited in your bank account? Net income is simply your earnings minus taxes and other deductions (e.g., contributions to a retirement account, health insurance, garnishments, etc…).

If your net income is not consistent and fluctuates each pay period, a good tip is to always round down. You want to be conservative on your budget. Any extra income from overtime hours, commissions, bonuses, etc… “is all gravy”. For years, I was in outside sales and my pay was a base salary plus commissions. We learned to create our budget based off of my base salary and never off of the commissions. We did this because we knew that income was coming in no matter what. It’s like the game of Monopoly:

– Base Salary or Hourly Rate: Like passing Go and getting $200 every time, it’s set.

– Commissions, Bonuses, etc…: Like landing on Community Chest and getting a positive card.

Hopefully you can avoid being thrown in Monopoly jail, which is like losing a job or other income stream.

Example of the “Income” piece of your budget:

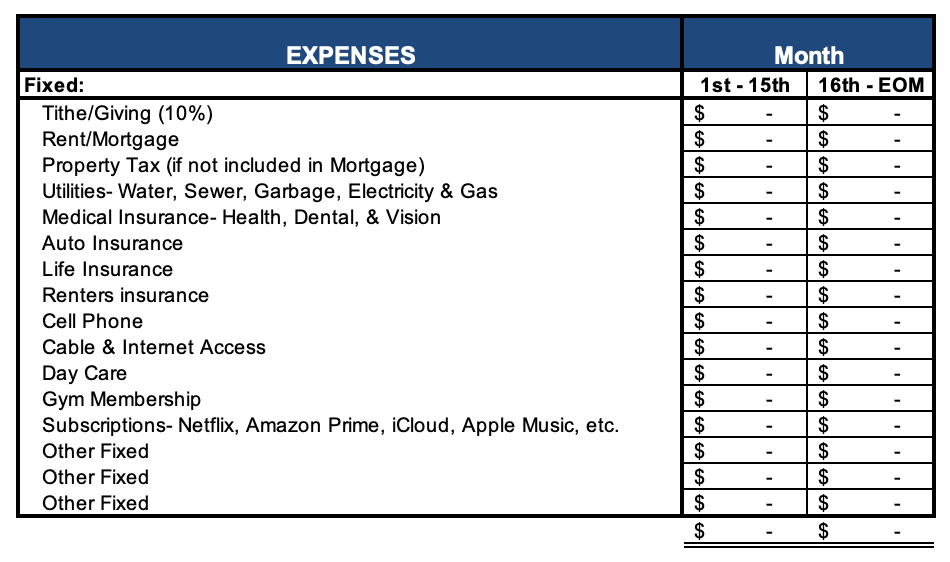

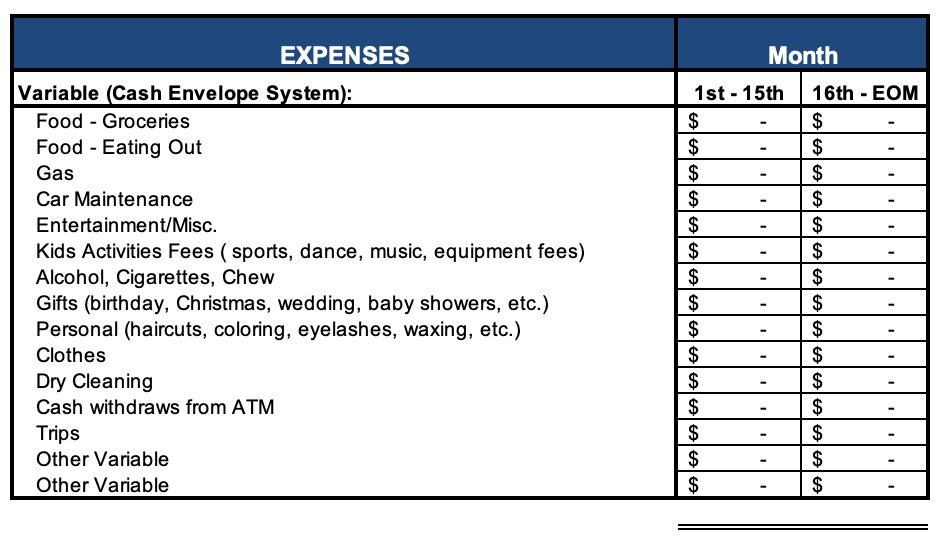

STEP 2: GET REAL WITH YOUR EXPENSES

The next step is to establish what is REALLY going out. I recommend looking at your bank and credit card statements for the last 3 months and adding up your actual spending by category. Divide this number by 3 and you have your actual monthly spending habits. We thought we were spending WAY less than we actually were, especially on our “fun” expenses (eating out, clothes, coffee, entertainment). Again, we had to get real with what we were actually doing. Similar to your income, you want to be conservative, round up on fluctuating expenses.

There are 2 types of expenses, Fixed and Variable. As the titles suggest, fixed expenses are the same each month and variable expenses fluctuate each month.

Examples of Fixed Expenses:

The most common problem I’ve seen in “Fixed Expenses” is people living beyond their means when it comes to their rent or mortgage. You don’t want to be house poor by overextending yourself on your rent or mortgage. I recommend this category to be no more than 20-25% or your expense budget.

The other thing that we were shocked by in our own budget was the amount of fixed subscription based fees that were chipping away at our income. For example, we had signed up for plans such as Netflix, Hulu, Amazon Prime, iCloud storage, Apple Music, Apple TV, Apple Arcade, Apple Care+ (maybe while Apple is so wealthy), ESPN+, Disney+, Pandora, Fit Radio, HBO, Cinemax, Showtime, and Starz, thinking “It’s only $10 a month”. The problem was that $10 a month multiplied by 20 subscriptions was all of a sudden $200 a month that we could have been putting toward our goals of paying off debt and/or saving money.

Examples of Variable Expenses:

The biggest holes we see when it comes to “Variable Expenses” are eating out, alcohol, entertainment, and those famous Starbucks or Dutch Brother coffee runs in the morning. We found the “cash envelope system” to help immensely in controlling our variable expenses. The cash envelope system is where you put money aside each month in an envelope for each one of the variable expense categories. Once the money is gone, you’re done spending on that category for the month. It is quite the eye opener when you open your “Coffee” envelope and the money is gone. Cash is tangible and holds you accountable. It is nearly impossible to do this when using a debit or credit card because it’s not as visible.

Once you get the totals for each category of expenses, you can move on to step three.

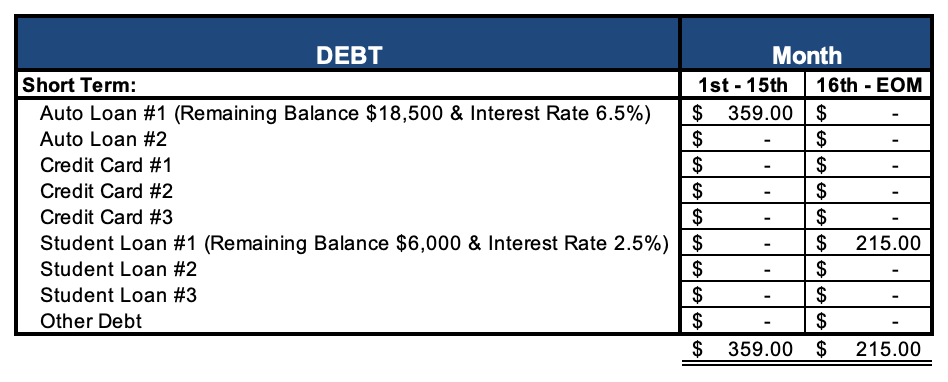

STEP 3: HOW MUCH DEBT AND SAVINGS DO YOU HAVE?

The next step is to compile each debt that you have and the amount of money you have in savings. Debt is simply the money that you owe to someone else. Savings is the amount of money you have saved (usually in a bank or other financial institution).

Examples of Debt:

When it comes to debt, list each debt separately including the minimum monthly payment and the remaining balance owed. For example:

- Auto Loan #1- $359/month (outstanding balance $18,500 and interest rate 6.5%)

- Student Loan #1- $215/month (outstanding balance $6,000 and interest rate 2.5%)

When it comes to Other Debt make sure to include money you have borrowed from people. I borrowed money from my parents for Ann’s engagement ring in college. This was the first debt we paid off as they were doing me a major favor and I didn’t want that debt to have a negative impact on our relationship.

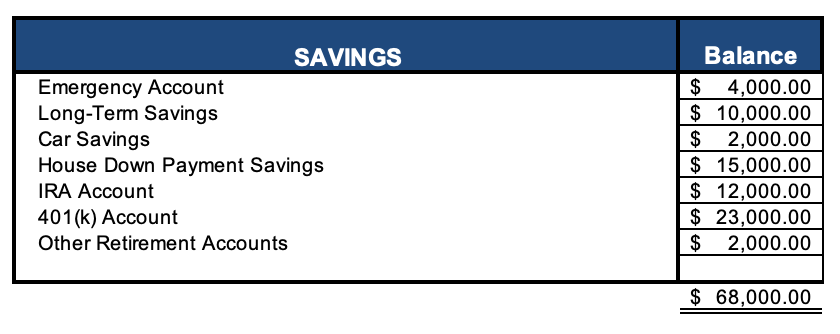

Examples of Savings:

List how much money you currently have saved by account.

STEP 4: PUT YOUR BUDGET TOGETHER

Now it is time to start bringing everything together in your budget! Your budget is simply:

Net Income

– Fixed Expenses

– Variable Expenses

– Minimum Debt Expense

Money Left Over to Reach Goals

BAM, now you have your monthly working budget! You are now taking control of your life and telling your money where to go. I know that this will take time to put together; however, it will be a game changer for you and your family. There is power in knowing what it costs to live and how much money you need to bring in!

STEP 5: COME UP WITH A REAL SOLUTION TO YOUR MONEY PROBLEMS

If you are like most people, you don’t like what the numbers have revealed. For us, we were left with a negative number at the end. In other words, we were going backward each month. This is where the real work begins. Your budget will be a work-in-progress over the years to come. You may even have to make some tough decisions on how to move forward. If you, like us, are in the negative each month, there are 2 main solutions:

Solution #1 – Decrease Your Expenses

Figure out what line items you can cut or get rid of. We started with decreasing our variable expenses. For example, did we really need Cable, Netflix, and Hulu? Based on our goal of getting debt free, it was an easy decision to remove 2 of the 3 (if not all 3 for a short time)! Did I really need to go out to eat or grab coffee every day or could I cut back to twice a month? These slight edge decisions add up over time and are necessary to get on track if you are in the red.

Solution #2 – Increase Your Income

A few ideas to increase your income:

- Pick up more hours of work. You can either do this at your current place of employment or adding another job.

- Find a higher paying job.

- Sell stuff on OfferUp or Craigslist – Are there things you don’t need anymore?

- Start a side hustle like driving for Uber, Lyft, or Grubhub, doing landscaping, helping someone move, refereeing sports, or making stuff and selling it.

- Start a business on the side of your job, and take your down time to build it.

These ideas above have worked for thousands of people and they can work for you. You have to realize there are 168 hours in a week. If you work 40 hours a week at a job and sleep 8 hours per night, you still have 72 hours a week of downtime. Take that downtime and make it productive!

We have incorporated many of the above ideas into our life to balance our budget and ultimately accomplish our goals of paying off debt, putting money into savings, and having leftovers to live a life of adventure. For us personally, the greatest positive impact to our budget was building our own business. I truly believe entrepreneurship is where it is at. We have received the greatest return of our time and money by building our own business versus working for someone else. I realized that if I could work hard for someone else, I could work even harder for my own dreams.

I wish you much $UCCE$$ as you go after your financial goals. Please drop a comment if this was helpful! We would love to hear from you!